Intelligence.

Expertise.

Automation.

One Marketplace.

CONNECT delivers vetted, lender-ready commercial lending opportunities in seconds.

One submission, one marketplace, and the right opportunities every time.

INTAKE

QUALIFICATION

VALIDATION

FINALIZATION

MARKETING

HOW IT WORKS

Choose Your Track - Our Process is Tailored to Brokers and Lenders

Brokers

Stop chasing. Start choosing.

Submit Once

Upload your deal and core docs

Pre-Underwrite

We standardize the package and screen for profile fit

Match & Manage

Instant routing to a nationwide lender network

Lenders

Deal flow without the noise.

Set Your Lending Box

Size band, programs, footprint, preferences

Get Profile-fit Deal Flow

Only pre-underwritten submissions that match your appetite

Evaluate - Don't Triage

Standardized memo, DSCR/LTV pass, normalized checklist

Get Results - 8 Point Pre-Underwriting

BROKERS:

With CONNECT, you will build a loan package that will help your deal standout from the rest and ensure your clients get best possible deal.

LENDERS:

Get vetted deals that fit your profile. We've collected, reviewed, and analyzed docs, so can pick deals that you can close.

Tax Returns and Financials

Sponsor Resume and Track Record

Standardized Data Room Link

Financial Package

DSCR/LTV Sizing Pass (quick math)

Analysis of asset and borrower strength against current market conditions

Property Docs Collection and Review

Eligibility Fit vs. Lender Profiles

BROKERS Build Highly Effective Loan Packages and Maximum Exposure

Lenders, Get Vetted, Relevant Deals Right to Your Inbox

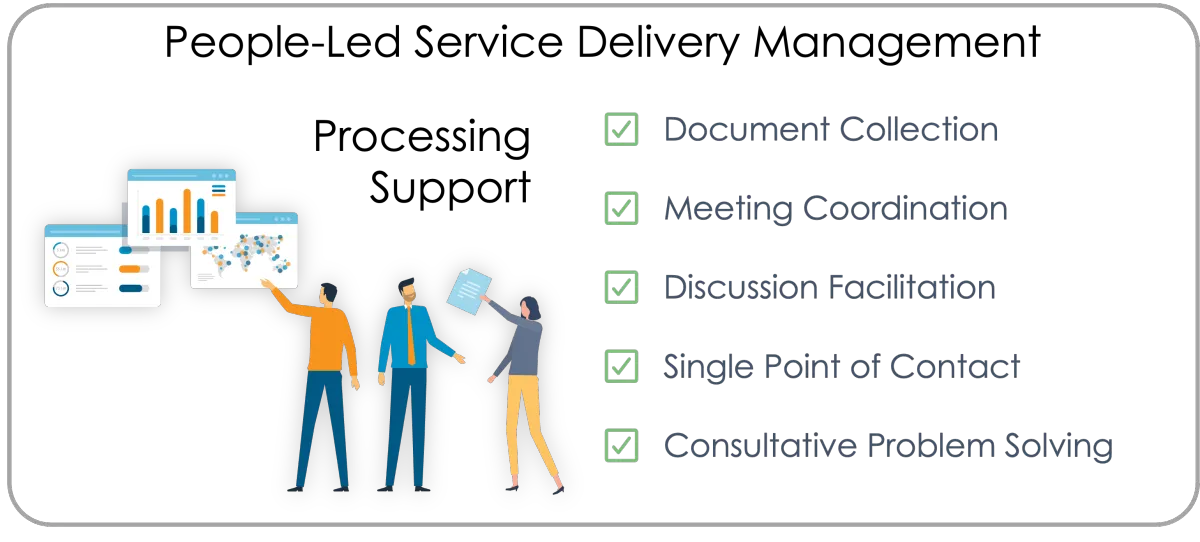

SUPPORT TEAM

The CONNECT team works on your behalf to help you from Deal Marketing through Deal Funding.

Whether you're a broker or lender, the CONNECT team will be there for you on each deal.

Brokers can leverage the platform and team creating low-cost staff augmentation, where there is full support for every step of the process. Brokers manage their clients, while the CONNECT team helps manage lender connections.

Lenders benefit from streamlined communication and a normalized view of each deal. Lenders will always know where to find the highlights and details for each opportunity, while having a consistent point of contact across all of the deals they select.

SUPPORTED LOAN TYPES

Explore a full spectrum of commercial lending solutions—each designed to fit your unique financing needs, timelines, and business goals. From traditional real estate loans to specialized financing for equipment, construction, or high-growth industries, CONNECT makes it easy to find the right loan, fast.

Every deal, every need—find your perfect loan type with CONNECT.

COMMERCIAL REAL ESTATE (CRE)

Financing for income-producing properties—acquisitions, refinances, or improvements.

SBA

Government-backed loans for business growth, real estate, or partner buyouts.

ALTERNATIVE LENDING

(Bridge/Hard Money)

Short-term, asset-based loans for quick closes, value-add, or distressed scenarios.

CONSTRUCTION

Funding for ground-up, renovation, or value-add building projects.

EQUIPMENT

Finance or lease business-critical equipment and technology.

PREFERRED EQUITY / MEZZANINE

Gap capital between senior debt and owner equity; boosts leverage without dilution.

CANNABIS

Funding for cannabis real estate, equipment, and working capital—non-bank sources.

CMBS

Non-recourse, pooled commercial loans with flexible terms.

NATIONWIDE LENDER POOL

Discover the broadest network of trusted commercial lenders—banks, credit unions, private funds, and specialized financiers—all in one place. CONNECT matches you to the right lender based on your deal profile, industry, and funding priorities, so you can secure the capital you need with confidence.t.

The right lender for every scenario—experience the CONNECT advantage.

BANKS

Traditional, relationship-driven lenders offering stability and competitive rates.

Banks provide a full suite of commercial loans for qualified borrowers, with strong regulatory oversight and long-term relationship potential. Ideal for stable, established businesses and properties.

CREDIT UNIONS & CUSOs

Member-focused lenders providing flexible and service-oriented financing.

Credit Unions and their CUSOs offer personalized lending experiences, often with local decision-making and tailored solutions for small to midsize businesses and community-based projects.

PRIVATE, HARD MONEY, & DEBT FUNDS

Asset-based lenders specializing in fast, creative, or challenging deal scenarios.

Private lenders, hard money specialists, and debt funds move quickly to finance bridge, value-add, or transitional projects. Perfect for time-sensitive opportunities or situations that require flexible structures and light documentation.

INSTITUTIONAL LENDERS (CMBS & Life Companies)

Institutional capital for large-scale, non-recourse, or complex transactions.

This group includes Capital Markets desks, CMBS lenders, and Life Insurance Companies—offering creative, long-term, or securitized financing for income-producing and trophy assets. Ideal for stabilized properties and larger, more sophisticated deals.

GOVERNMENT-BACKED LOANS

Providers of SBA, USDA, and other government-supported programs for businesses and real estate.

Government-backed lenders deliver powerful solutions with longer terms, lower down payments, and unique structures—backed by the SBA, USDA, or other agencies. Ideal for small businesses and rural or mission-driven projects.

PREFERRED EQUITY / MEZZANINE

Flexible capital partners bridging the gap between senior debt and equity.

Preferred equity and mezzanine funds enable higher leverage, larger deals, or strategic recapitalizations—providing creative financing that complements traditional loans, all without giving up significant ownership.

EQUIPMENT & ASSET BASED LENDERS

Lenders focused on equipment financing, leasing, and working capital tied to business assets.

This group specializes in unlocking capital from business assets, whether you need new equipment, technology upgrades, or working capital for growth. Fast approvals and a variety of structures keep your business moving.

SPECIALTY

Industry-specific and niche lenders for sectors like cannabis, healthcare, and unique asset classes.

Specialty lenders focus on emerging or underserved markets, providing tailored capital solutions for businesses and projects that fall outside conventional lending guidelines. CONNECT opens doors to funding for cannabis, franchise, healthcare, and more.

READY TO GET STARTED?

Book Your Demo and Onboarding Session Today!

CONNECT. All rights reserved